CELEBRITY

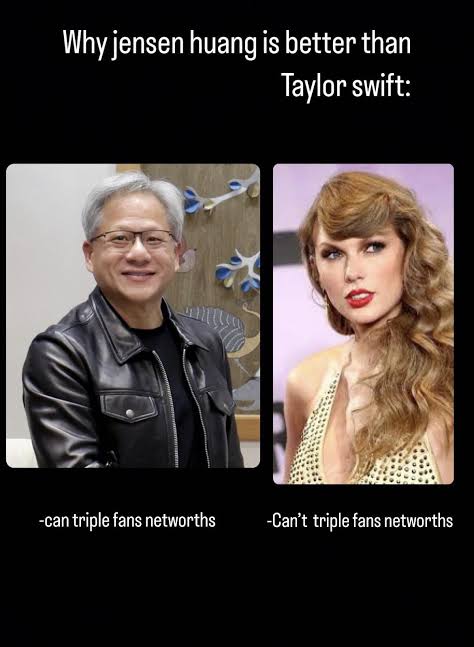

The Ex-Waiter Who Built Nvidia And Became The €105bn Taylor Swift Of Tech

Great ventures often spring from humble beginnings and that’s certainly true for Nvidia, the Silicon Valley microchip giant newly crowned the world’s most valuable public company, writes Tom Leonard.

The tech juggernaut’s figurehead and co-founder dreamed up the future behemoth during his 30th birthday – at a branch of the US roadside diner chain Denny’s outside San Jose, California.

Jensen Huang had worked at Denny’s first as a dishwasher and then as a waiter. But, on that night in 1993, his mind was focused on weightier matters than whether or not Table 5 had ordered the cheesecake.

He and two friends, chip designers Chris Malachowsky and Curtis Priem, ‘brainstormed and fantasised’ about going into business together and eventually used $40,000 of their own money to start a company now worth a staggering $3.34tn (€3.12tn).

For its first few decades, Nvidia devoted itself to producing high-end computer-graphics hardware for the video-game sector. Then, in around 2016, Nvidia made the fateful decision to refocus on the emerging field of generative artificial intelligence, or AI.

They had originally called their company ‘NVision’ but discovered it was already taken by a toilet paper manufacturer. Huang, a Taiwan-born electrical engineer whose parents had sent him to the US as a child, suggested the name Nvidia from invidia, the Latin word for envy.

And envy sums up the business world’s attitude to Nvidia now. The company that for most of its existence was little known to anyone outside the world of video-game graphics is widely expected by investors to remain a crucial player in the artificial intelligence market – if the alleged bubble doesn’t burst.

Based in Santa Clara, California with some 30,000 employees, Nvidia is now worth more than all the companies listed on the London Stock Exchange combined, and has driven the S&P stock market index to record highs in the US.

Yet while Microsoft and Apple grew steadily to become trillion-dollar companies, Nvidia’s recent rise has been meteoric. Its shares have tripled in value in the past 12 months, as customers – including Amazon and Meta (owner of Facebook) – pile in to AI, where Nvidia dominates the supply of the vital GPU (graphics processing unit) chips.

Silicon Valley is swooning. Facebook founder Mark Zuckerberg has described Huang as the “Taylor Swift of tech,” and the 61-year-old’s resemblance to a pop superstar goes beyond the expensive leather jackets that are his hallmark.

In Taiwan, the capital of chip manufacturing, Huang is regarded as a national hero, mobbed by large crowds chanting his name and demanding his autograph. Huang, seen this week in a $9,000 Tom Ford biker jacket, is revelling in the adulation after years away from the limelight as he built his company.

Earlier this month, he was even seen scrawling his signature on a female fan’s shirt at a tech convention in Taiwan, wondering aloud if doing so was a “good idea”.

With a personal fortune estimated at €105bn – making him the world’s 11th-richest person – the unassuming Huang could be forgiven for a few slips. Having decided years ago to bet on AI, Nvidia is now exploiting what analysts call its “stranglehold” on the supply of the hardware that any company needs if it wants to jump on the artificial intelligence bandwagon.

Some warn that AI is being ridiculously over-hyped but, for the moment, Huang and Nvidia are riding high on what observers have dubbed ‘Jensanity’.

Huang, whose first name is actually Jen-Hsuin, was born in the Taiwanese city of Tainan in 1963.

When he was five, his family moved to Thailand but his father, a chemical engineer at a US air conditioner manufacturer, vowed to move them all to America after visiting the country for job training. Despite not speaking English, Jensen’s mother taught him and his brother ten new words she selected every day from a dictionary in preparation for the move.

The two children moved to the US in 1973, living with an uncle in Washington state as they waited for their parents to join them.

Unfortunately, Huang and his brother ended up at a tough Baptist reform school for ‘problematic’ children in Kentucky, which their uncle had mistaken for a prestigious boarding school. The nine-year-old Huang shared a room with a 17-year-old, who on the younger boy’s first night proudly showed him the various stab wounds he had received.

Huang was assigned to cleaning the toilets and was mercilessly bullied, although he says it taught him resilience which he regards as essential to success. “The kids were really tough,” he has recalled. “They all had knives – and when they get in fights, it’s not pretty.”

Huang developed a passion for computer games and table tennis rather than knife-fighting, later studying electrical engineering at Oregon State University where he met his wife, Lori Mills, who was his lab partner.

He says his “killer” pick-up line was offering to show her his homework. They now have two children and at least two multi-million homes – a $33million Hawaii getaway and a $44 million mansion in San Francisco.

To earn money as a teenager he worked at a local branch of Denny’s. “I was a very good student and I was always focused and driven,” he said. “But I was very introverted … the one experience that pulled me out of my shell was waiting tables at Denny’s. I was horrified by having to talk to people.”

Nowadays, he’s the CEO and business guru whose advice everyone wants to hear. And with analysts estimating it may take a decade for any competitor to catch up on Nvidia, Huang is enjoying his moment, boasting how his company has ushered in “the next industrial revolution”.

But is it? Silicon Valley bows to no one when it comes to trumpeting its own brilliance and importance. Some ask whether the feverish excitement over AI – and the rocketing valuations put on the businesses involved in it – is justified or sustainable.

For these sceptics, Nvidia has all the hallmarks of a classic Silicon Valley bubble. Investors and developers who stand to make vast fortunes off it have hailed AI – super-intelligent computers that can outperform humans by drawing from the vast trove of information on the internet – as world-changing.

And yet a wave of recent reports – including revelations that Google’s AI recommends putting glue on pizza and eating “a rock a day” – suggest there’s nothing particularly intelligent, let alone super-intelligent, about a technology with so many flaws.

Meanwhile, concerns about the misuse of AI have fuelled calls for the industry to be policed and profit-hungry entrepreneurs reined in. That, too, could be bad news for Nvidia.

There are other potential problems ahead. The US government is investigating Nvidia over suspicions it has a virtual monopoly. A competition probe looms and Nvidia’s share price wobbled earlier this month as a result.

China could provide a far worse nightmare for the company. Nvidia doesn’t manufacture its own chips but farms out production to contractors in Taiwan. If China invades or blockades its island neighbour as part of President Xi’s pledge to ‘reunify’ the countries, Nvidia would clearly be in considerable trouble.

The tech industry has proved to be particularly prone to bubbles (witness the endless speculative drama over cryptocurrencies such as Bitcoin) while the backlash against AI has already begun.

In April, Unilever’s beauty brand Dove announced it would never use AI-generated images to represent women in adverts. For many, AI has become a byword for fakery and unreliability.

But while some experts predict AI is a bubble that must burst, others are convinced Nvidia is actually undervalued, given the technology’s potential and the company’s position as an AI ‘gatekeeper’. As the world demands ever more AI-based innovations, they argue, Nvidia – currently producing a new generation of even more advanced chips – can only get richer.

Meanwhile, the booth in Denny’s where Huang and his two partners sat that momentous night now bears a plaque honouring the spot that “launched a trillion dollar company”. Whatever happens to Nvidia, at least that plaque won’t be going anywhere.